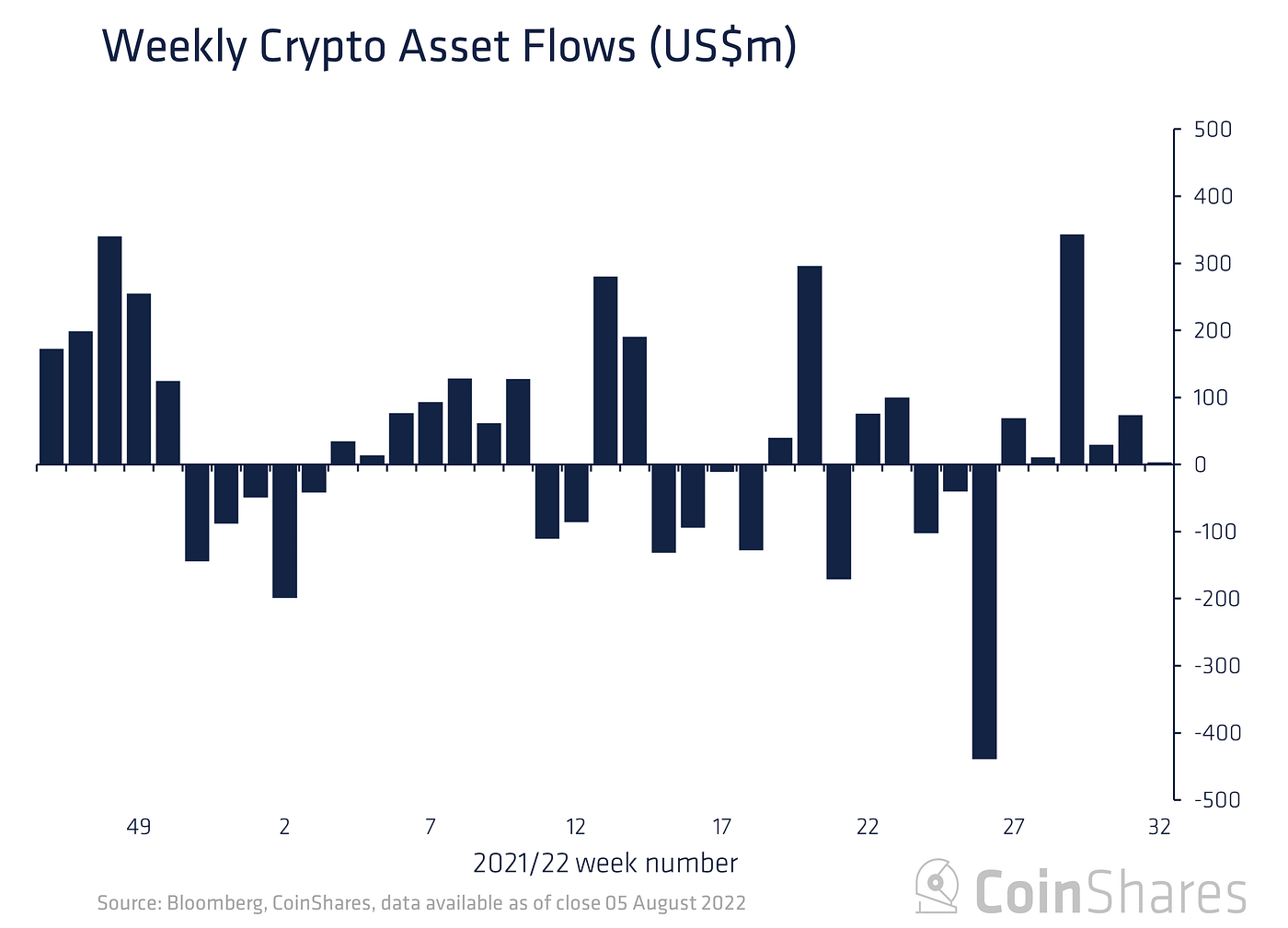

Inflows into crypto investment products have been experiencing an uptick for six consecutive weeks, topping $500 million, according to a report by market insight provider CoinShares.

The study dubbed “Volume 92: Digital Asset Fund Flows Weekly Report” highlighted:

“Digital asset investment products saw inflows totalling US$3m last week marking the 6th consecutive week of inflows that total US$529m, representing 1.7% of total assets under management (AuM).”

Source:CoinShares

CoinShares noted that constant inflows are happening despite the crash in the crypto market witnessed in the second quarter of 2022.

As the much-anticipated merge in the Ethereum network edges closer, more inflows have been trickling into the second-largest cryptocurrency. The report pointed out:

“Ethereum saw inflows totalling US$16m and is enjoying a near 7 consecutive week run of inflows totalling US$159m. We believe this turn-around in investor sentiment is due to greater clarity on the timing of The Merge.”

The merge, which is expected to happen on September 19, will change the current proof-of-work (PoW) framework to a proof-of-stake (PoS) consensus mechanism. Moreover, it’s speculated to be the biggest software upgrade in the Ethereum ecosystem.

American multinational investment bank Citi recently noted that the merge would make Ethereum a “yield-bearing asset,” Blockchain.News reported.

On the other hand, CoinShares noted that despite sentiment in the crypto market improving, trading volumes remained low the past week at $1.1 billion compared to the year-to-date weekly average of $2.4 billion.

“Bitcoin saw very minor outflows totalling US$8.5m while short-Bitcoin investment products saw a record outflow totalling US$7.5m, and for the second consecutive week suggesting investors believe Bitcoin prices have troughed,” CoinShares added.

Image source: Shutterstock