Top Stories This Week

Binance founder CZ must stay in US until sentencing, judge orders

Binance founder Changpeng “CZ” Zhao has been ordered to stay in the United States until his sentencing in February, with a federal judge determining there’s too much of a flight risk if the former crypto exchange CEO is allowed to return to the United Arab Emirates. On Dec. 7, Seattle District Court Judge Richard Jones ordered Zhao to stay in the U.S. until his Feb. 23, 2024 sentencing date. He faces up to 18 months in prison after pleading guilty to money laundering on Nov. 21 and has agreed not to appeal any potential sentence up to that length.

House committee passes bill to ‘preserve US leadership’ in blockchain

A United States Congress committee has unanimously passed a pro-blockchain bill, which would task the U.S. commerce secretary with promoting blockchain deployment and thus potentially increase the country’s use of blockchain technology. The act covers an array of actions the commerce secretary must take if passed, including making best practices, policies and recommendations for the public and private sector when using blockchain tech. The bill will now go to the House for a vote. If passed, it must also pass in the Senate before returning for final congressional and presidential approval.

SEC pushes deadline to decide on Grayscale spot Ether ETF

The United States Securities and Exchange Commission has delayed its decision on whether to approve or reject a spot Ether exchange-traded fund (ETF) offering from asset manager Grayscale. In a notice, the SEC said it would designate a longer period for considering a proposed rule change that would allow NYSE Arca to list and trade shares of the Grayscale Ethereum Trust. Grayscale first filed with the SEC to convert shares of its Grayscale Ethereum Trust into a spot Ether ETF in October, adding its name to the list of companies awaiting a decision from the regulator.

Elon Musk’s xAI files with SEC for private sale of $1B in unregistered securities

Elon Musk’s X-linked artificial intelligence modeler, xAI, has an agreement for the private sale of $865.3 million in unregistered equity securities, according to a filing with the United States Securities and Exchange Commission made on Dec. 5. The company is seeking to raise $1 billion. XAI’s product, a chatbot called Grok, has recently rolled out to X’s Premium+ subscribers. Musk announced the launch of xAI in July and claimed its goal was to “understand the universe.”

Bitcoin new high set for late 2024, Binance to lose top spot — VanEck

Bitcoin will hit a new all-time high in late 2024 because of a long-feared United States recession and regulatory shifts after the next U.S. presidential election, asset manager VanEck predicts. The firm is confident that the first spot Bitcoin ETFs will be approved in the first quarter of 2024. However, it also made a gloomy prediction for the general U.S. economy. VanEck is among several firms, including BlackRock and Fidelity, that are vying for an approved spot Bitcoin ETF. VanEck also believes that the BTC halving, due in April or May, “will see minimal market disruption,” but there will be a post-halving price rise.

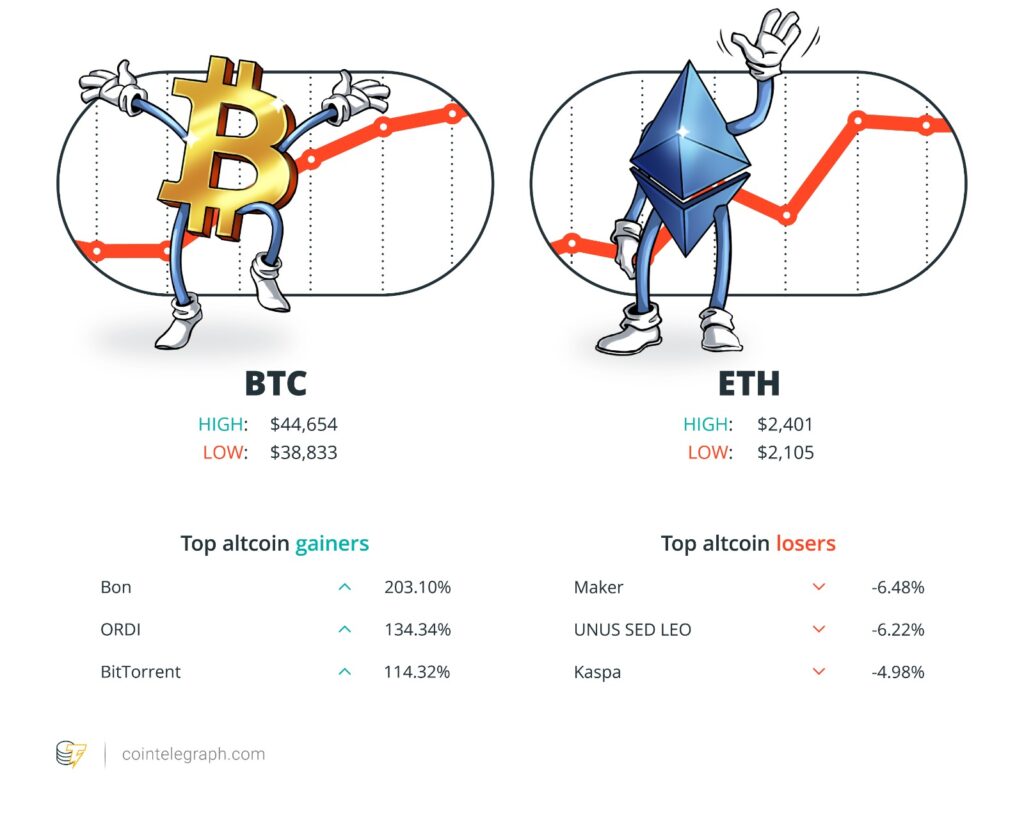

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $44,402, Ether (ETH) at $2,364 and XRP at $0.66. The total market cap is at $1.65 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Bonk (BONK) at 203.10%, ORDI (ORDI) at 134.34% and BitTorrent (BTT) at 114.32%.

The top three altcoin losers of the week are Maker (MKR) at -6.48%, UNUS SED LEO (LEO) at -6.22% and Kaspa (KAS) at 4.98%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Read also

Most Memorable Quotations

“The expected approval of the ETF will be positive news for the crypto market, likely leading to significant growth.”

Adam Berker, senior legal counsel at Mercuryo

“The only true use case for it [crypto] is criminals, drug traffickers, money laundering, tax avoidance.”

Jamie Dimon, CEO of JPMorgan Chase

“Jamie Dimon is in no position to criticize Bitcoin with this sort of track record.”

Gabor Gurbacs, strategy adviser at VanEck

“So, for us, I think Bitcoin is our central bank. With that in mind, I think of Ethereum as our investment bank.”

Robby Yung, CEO of Animoca Brands

“The ETF is certainly a key driver in sentiment.”

Jon de Wet, investment chief of Zerocap

“It takes a community and the whole industry to figure out how to better educate people. That’s the hard part. It’s not a technology issue; it’s an operational problem.”

Eowyn Chen, CEO of Trust Wallet

Prediction of the week

‘Early bull market’ — Bitcoin price preps 1st ever weekly golden cross

Bitcoin is lining up an “early bull market” as a unique chart feature plays out for the first time in history.

In a post on X (formerly Twitter) on Dec. 7, entrepreneur Alistair Milne noted that should current performance continue, Bitcoin will witness a crossover of two weekly moving averages (MAs), which have never delivered such a bull signal before.

The 50-week and 200-week MAs are key trendlines for Bitcoin traders and analysts alike. The latter is the ultimate bear market support level, and it has so far never decreased in value.

BTC price strength is on the way to taking the 50-week MA trendline above the 200-week counterpart. Known as a “golden cross,” on lower timeframes, this is considered a classic bullish signal, and for Milne, the impetus is that considerable upside could be in store should the phenomenon play out.

“The 50-week moving average will now soon cross back above the 200-week MA making a ‘golden cross’ for the 1st time. QED: Early bull market,” he wrote.

FUD of the Week

Crypto is for criminals? JPMorgan has been fined $39B and has its own token

JPMorgan Chase CEO Jamie Dimon is being criticized by the crypto community after claiming Bitcoin and cryptocurrency’s “only true use case” is to facilitate crime. However, according to Good Jobs First’s violation tracker, JPMorgan is the second-largest penalized bank, having paid $39.3 billion in fines across 272 violations since 2000. About $38 billion of these fines came under Dimon’s watch, who has been CEO since 2005.

British regulator adds Justin Sun-linked Poloniex to warning list after $100M hack

The United Kingdom’s Financial Conduct Authority (FCA) has added crypto exchange Poloniex to its warning list of non-authorized companies. The Seychelles-based exchange is one of the three companies owned by or affiliated with entrepreneur Justin Sun that have suffered four hacks in the last two months. The warning to Poloniex was published on the FCA’s website on Dec. 6. It doesn’t offer a reason but says that “firms and individuals cannot promote financial services in the UK without the necessary authorization or approval.”

US senators target crypto in bill enforcing sanctions on terrorist groups

A bipartisan group of lawmakers in the United States Senate introduced legislation aimed at countering cryptocurrency’s role in financing terrorism, explicitly citing the Oct. 7 attack by Hamas on Israel. The bill would expand U.S. sanctions to include parties funding terrorist organizations with cryptocurrency or fiat. According to Senator Mitt Romney, the legislation would allow the U.S. Treasury Department to go after “emerging threats involving digital assets.”

Read also

Top Magazine Pieces of the Week

Lawmakers’ fear and doubt drives proposed crypto regulations in US

If the Digital Asset Anti-Money Laundering Act were to become law, many cryptocurrency providers would have to learn how to comply with the same regulations as traditional financial institutions.

Expect ‘records broken’ by Bitcoin ETF: Brett Harrison (ex-FTX US), X Hall of Flame

Brett Harrison taught a promising young Sam Bankman-Fried programming for traders at Jane Street, but wasn’t so impressed with the man SBF became.

Web3 Gamer: Games need bots? Illuvium CEO admits ‘it’s tough,’ 42X upside

Games overrun with bots just show bot owners care, claims Pixels founder. Plus we review Galaxy Fight Club, chat to Illuvium’s CEO and more.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.